Incident response should sit at the very heart of your fleet’s risk management strategy, says Callum Langan, Managing Director at Driving for Better Business partners, sopp+sopp. The faster and more accurately incidents are reported after they occur, the more effectively you can respond to mitigate the associated risks and promote positive outcomes.

So what is digital incident reporting and how can it help those who manage drivers?

Fleet managers – incident reporting

If incidents aren’t reported effectively, you risk missing out on vital details about what occurred, and who was involved. This hinders your ability to respond effectively to mitigate risk, ensure driver safety, and control the cost of third-party claims.

One answer lies in providing quicker, more accessible, and more accurate ways for drivers to report incidents after they occur – and delivering a wealth of data to inform swift risk management.

That’s where digital incident reporting solutions come in. They usually take the form of web-apps, which allow your drivers to report incidents immediately, from the scene, using their mobile phone or tablet.

Let’s discuss how these solutions work, and how they could help your fleet to manage the risks associated with traffic collisions.

What is ‘digital incident reporting’?

Digital incident reporting leverages online applications, like portals and web-apps, to enhance the collection of incident data, rather than requiring drivers to phone in right away.

This helps to tackle some of the inconsistencies found when using telephone reporting in isolation, and delivers a more responsive reporting strategy.

This digitally-enabled process aims to ensure incidents are reported quickly and consistently – no matter the time, severity, or location.

Electronic Notification of Loss (eNOL) solutions

Electronic Notification of Loss (eNOL) solutions are a popular form of digital incident reporting.

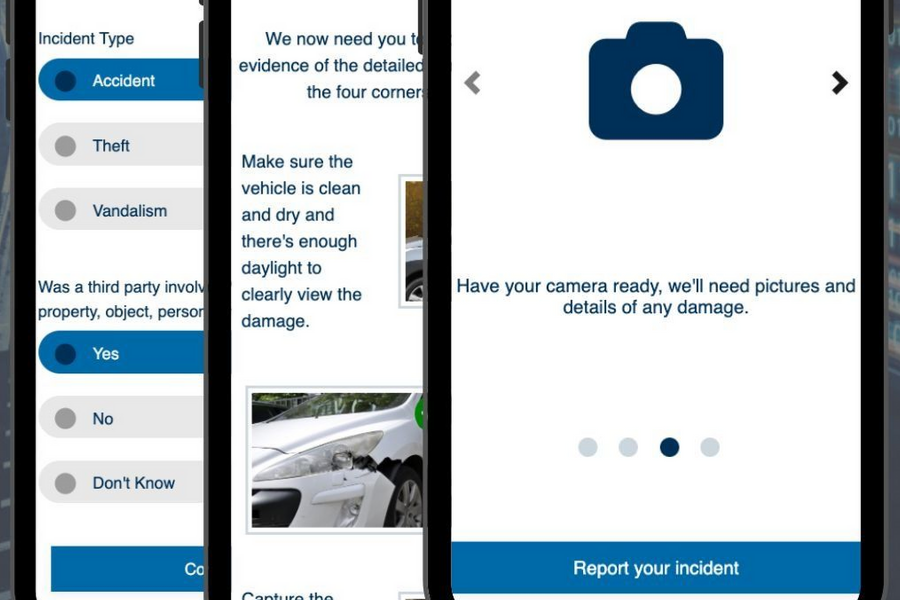

They seek to streamline parts of the FNOL process by allowing drivers to submit incident reports via their mobile, and upload data like visual evidence or third-party details instantly.

This is usually done using a mobile web-app, which is accessed via a link, and prompts drivers to fill out a step-by-step, guided report, which mirrors your telephone FNOL process.

This enables you to collect all the information you need to respond to incidents quickly, without requiring drivers to make an initial phone call.

Once the digital report has been completed, it’s received immediately, allowing a claims handler to speak with the driver over the phone to verify details, and ensure solutions are deployed quickly.

7 benefits of eNOL solutions for fleet risk management

Here are some examples of how eNOL solutions can help fleets to manage risk throughout their accident management process.

1 – They ensure quick & consistent incident response

Swift and detailed incident reports enable you to respond quickly and consistently to manage accidents, and mitigate their associated risks. eNOL solutions are a straightforward way to achieve this, ensuring your drivers always know what to do when they’re involved in a collision, and their reports are received immediately.

2 – They can be used alongside telephone reporting for a ‘hybrid’ approach

eNOL applications don’t have to be used in isolation. They can be implemented alongside your existing telephone reporting in a ‘hybrid’ approach – increasing accessibility, promoting efficiency, and minimising risk. Keeping both options open ensures drivers always have a pathway to report incidents quickly, and that your team can follow up quickly if more information is needed.

3 – They can be integrated with onboard telematics & dashcams

Many eNOL solutions can be integrated with telematics devices present on your fleet’s vehicles, which can further speed up and even automate parts of the reporting process. Onboard technology can detect when a collision occurs, and automatically trigger an eNOL incident report – incorporating both the vehicle’s live location, and even dashcam footage.

4 – Recovery, rescue, and repair can be deployed immediately

The data provided by eNOL reports helps to inform the swift, right-first-time deployment of recovery & repair services. You’ll know exactly what solutions are needed, and where they need to be sent, allowing you to act quickly to ensure driver safety, and recover your vehicles if needed. Most eNOL apps also prompt drivers to upload images of any damage sustained, allowing you to assess repair requirements remotely, and even get a quote for the work needed.

5 – They ensure visual evidence is captured & uploaded quickly

As mentioned, most eNOL solutions prompt drivers to capture and upload images of their vehicle, and any damage it has sustained, as soon as the report is initiated. This helps to increase the capture rate of visual data, which can be used to inform your triage, engineering, and repair processes. Images can usually be taken using the in-app camera function, and uploaded quickly at the touch of a button.

6 – Third parties are captured swiftly, protecting brand reputation

eNOL solutions prompt your drivers to input third-party details at the scene, increasing the chance that they’re captured and contacted swiftly by your claims team. This gives you more control over reputation management when your drivers are at-fault, and helps to ensure third-party vehicles are placed and repaired within your own network – mitigating cost.

7 – They provide a wealth of data to inform your risk strategy

The data collected through eNOL reporting can be easily exported, formatted, and analysed for any trends. This might include assessing the types of incidents your drivers most commonly encounter, when/where they happen, and how long it takes for drivers to report them. This allows you to make data-backed optimisations to your risk management strategy – including through targeted driver training, route planning, and further streamlining your incident reporting process.

Fleet accident management in Summary

Digital incident reporting solutions are transforming the way fleets approach accident management – making it quicker and easier for drivers to report collisions, and for fleets to respond effectively.

These include electronic Notification of Loss (eNOL) solutions, which use web-apps to allow your drivers to report incidents at the scene through a guided, mobile-friendly process.

After they encounter an incident, drivers simply load the eNOL web-app via a link, and fill out the guided form to complete their incident report – and upload supporting evidence.

Utilising an eNOL solution has a number of advantages for your risk management strategy, including:

– It ensures quick & consistent incident reporting and accident management

– It can be used in combination with your existing telephone reporting process

– It can be integrated with onboard telematics to automatically initiate incident reports

– Recovery, rescue, and repair services can be informed & deployed immediately

– Third-parties can be captured at the scene, ensuring swift engagement & cost mitigation

– It provides a wealth of exportable data to inform your future risk strategies