Our latest blog on First Notification of Loss comes to us from Renee Rogers of ONO, and looks at how safer outcomes and business benefits can be driven by clear, concise and timely reporting.

Why First Notification of Loss Matters More Than Ever

In the world of fleet operations, incidents are not a matter of if, but when.

Despite all efforts to reduce work related road risk and promote driver vigilance, collisions and near misses are an unavoidable part of operating vehicles at scale. What sets top performing fleets apart isn’t whether incidents happen, it’s how they deal with them.

Fast, accurate reporting makes all the difference. That’s why First Notification of Loss (FNOL) isn’t just a form to fill in, it’s a frontline tool for managing risk, staying compliant, and keeping costs down. When fleets take FNOL seriously and get it right, the benefits are clear: faster decisions, lower claims costs, better outcomes for insurers, operators, and drivers.

What is FNOL and Why Does it Matter?

FNOL is the process of reporting the first details of a loss, usually a road traffic collision or damage to an insurer, fleet manager, or third-party service provider. It typically includes the time, date, location, people involved, damage incurred, and contextual factors such as weather or road conditions.

In a traditional setting, FNOL might happen hours or even days after an incident, depending on when the driver returns to base or completes a manual report. In a digital world, there’s no room for slow FNOL. Delays don’t just drain your budget, they leave drivers unsupported, customers let down, and reputations on the line. The social and economic cost stacks up fast.

Quick, accurate reporting isn’t optional, it’s what responsible fleets do.

The Business Case for Prompt FNOL

1. Insurance and Liability Management

Prompt FNOL is essential for managing claims efficiently. The earlier a claim is reported:

● The better the chance of accurate evidence collection (photos, dashcam footage, witness statements).

● The lower the likelihood of exaggerated third-party claims.

● The more efficient liability can be established and legal costs controlled.

Insurers regularly cite FNOL timing as one of the biggest factors affecting the cost and duration of a claim.

According to industry research from Flock, “late FNOL reporting can increase total claim costs by over £5,000. Incidents reported more than 24 hours after they occur often result in slower repair timelines and longer vehicle downtime, driving up costs across the board” (Flock, 2023).

2. Operational and Economic Impact

Fleet downtime is a major financial risk. When a vehicle is out of service due to an unresolved or poorly managed incident, it not only affects service delivery, it directly hits the bottom line.

Timely FNOL:

● Enables faster repair authorisation and vehicle recovery.

● Minimises disruption by keeping fleet managers informed.

● Helps with temporary vehicle allocation or route adjustments.

Moreover, delays in reporting can lead to compounding costs from extended hire vehicles, idle drivers, and missed SLAs with customers.

3. Improved Post-Incident Investigation and Risk Reduction

FNOL isn’t just about reporting an incident, it sets the stage for investigating what went wrong and how to prevent it from recurring.

A detailed, timestamped FNOL can act as a first layer of forensic insight. A good FNOL report contributes to:

● Root cause analysis: Was fatigue a factor? Was visibility low? Did the driver notice a mechanical issue before the incident?

● Driver feedback and retraining: Prompt reporting enables human review while details are still fresh.

● Vehicle defect tracking: When paired with vehicle condition reporting (e.g. pre-journey checks), FNOL can help identify systemic maintenance issues.

Post-incident reviews are only as good as the data feeding them. A complete, consistent FNOL record dramatically improves the quality of internal investigations, which in turn supports better driver safety and compliance performance.

FNOL – Why Digital Detail Matters

Promptness without accuracy is only half the story. An FNOL form that lacks detail or consistency forces insurers or fleet teams to chase additional information, delaying the whole process.

A good FNOL report should include:

● Precise location data (ideally GPS-verified)

● Photos or videos of the scene

● Named parties and contact information

● Vehicle condition checklist

● Environmental context (e.g., lighting, weather)

● Driver statement in their own words

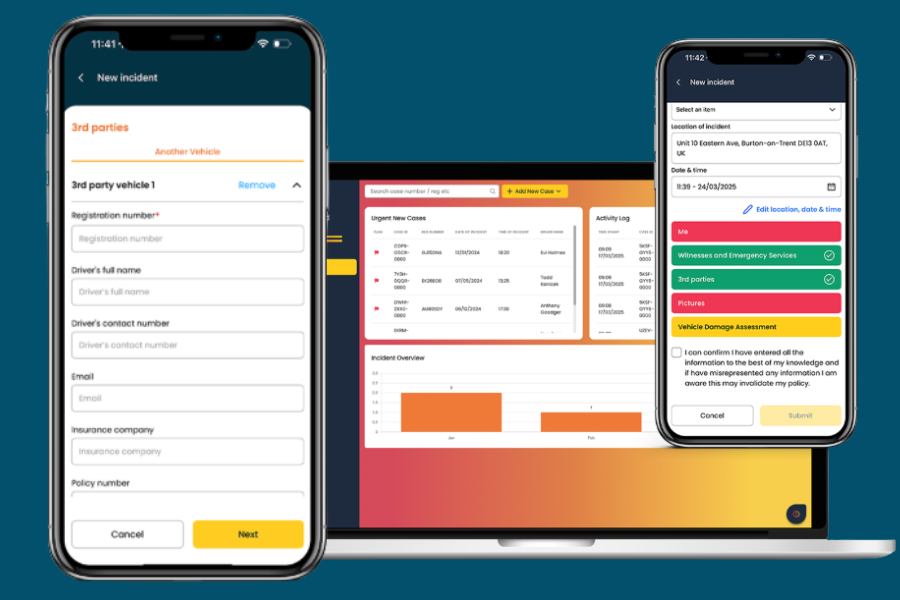

Apps can streamline this by giving drivers a simple mobile interface that prompts them step-by-step while evidence is still fresh. It’s surprising how many fleets are still handing out handwritten “bump cards” for drivers to fill in after a collision. Paper forms, scribbled notes, and a delayed handover to admin staff – it’s outdated, error prone, and completely at odds with how professional fleet operations run today. When incidents happen, every minute matters. Relying on paper based FNOL reporting introduces delays, misses key evidence, and puts unnecessary pressure on drivers to remember what happened hours or even days later.

To manage incidents properly, fleets need more than spreadsheets or manual logs. They need a structured, digital FNOL system such as ONO that’s designed for real-time capture, consistent data, and smart workflows, driving better outcomes across safety, cost control, and driver welfare.

FNOL Is About More Than Just Insurance

Too often, FNOL is only seen as part of the insurance process. But not every incident leads to a claim and that doesn’t mean it shouldn’t be logged.

Near misses, low speed knocks, and minor damage are all part of a fleet’s operating reality. These smaller events, when recorded consistently, can reveal important trends in driver behaviour, route risks, or vehicle wear. A digital FNOL platform helps build a comprehensive incident history for every vehicle and driver, not just when insurers are involved. This fleet wide visibility enables better coaching, maintenance decisions, and road risk management strategies.

Barriers to Good FNOL (and How to Fix Them)

Despite the benefits, many fleets still struggle with FNOL adoption. Common barriers include:

● Driver reluctance or fear of blame.

● Cumbersome or paper-based reporting processes.

● Lack of training or awareness.

To overcome these:

● Make FNOL culturally normal, not punitive.

● Use digital tools that guide rather than burden.

● Provide feedback loops showing how FNOL contributes to improvements.

● Reward transparency, not just safety outcomes.

Ultimately, making FNOL work isn’t about adding pressure, it’s about removing friction. When fleets create a culture that values speed of response, clarity, and learning, and back it up with the right tools and support, FNOL becomes second nature, not a box-ticking exercise.

Key Areas Where FNOL Impacts Fleet Success

Here are the key areas where strong FNOL processes deliver real business impact.

A. Insurance Cost Control

● Reduced claim lifecycles.

● Controlled third-party costs.

● Improved renewal premiums due to effective claims management.

B. Compliance & Audit Readiness

● Aligns with DVSA and Health & Safety Executive (HSE) requirements on incident reporting.

● Creates defensible records in the event of legal proceedings.

C. Driver Support and Welfare

● Allows for quicker HR or health and safety follow-up.

● Ensures drivers feel heard and supported after an incident, reducing long-term stress or blame culture.

D. Data and Continuous Improvement

● Feeds into KPI dashboards for fleet performance.

● Helps identify high risk routes, times of day, or weather patterns.

● Can integrate with telematics, dashcams, or incident management platforms to build an intelligent risk profile.

Conclusion: Treat FNOL as a Business Tool, Not Just a Report

First Notification of Loss is no longer just a functional step in claims reporting – it’s a strategic asset for fleets seeking to improve safety, reduce costs, and make smarter decisions.

In an age of instant data, every hour lost post-incident adds risk, confusion, and cost. But every prompt, accurate FNOL submission adds clarity, protection, and insight. Fleets that get FNOL right don’t just respond better to incidents, they build stronger systems that prevent the next one.